The Global Risk Exchange (or GRE) is a block-based, decentralized and open global risk exchange market with the aim of helping individuals and companies and organizations access and trade and manage their risks. GRE has completely reconstructed traditional risk management tools (insurance and derivative contracts) in a decentralized manner and will become the basic operating system for supporting insurance transactions and derivative transactions in the era of blocking. GRE is seeking in the near future to build the infrastructure and trading platform for the risk management industry in the world, managed by block chains, by providing a basic protocol for creating risk events, pricing, trading, gathering information and oracles in order to identify specific risks. This will allow individuals and institutions around the world to achieve a balance between risk and return.

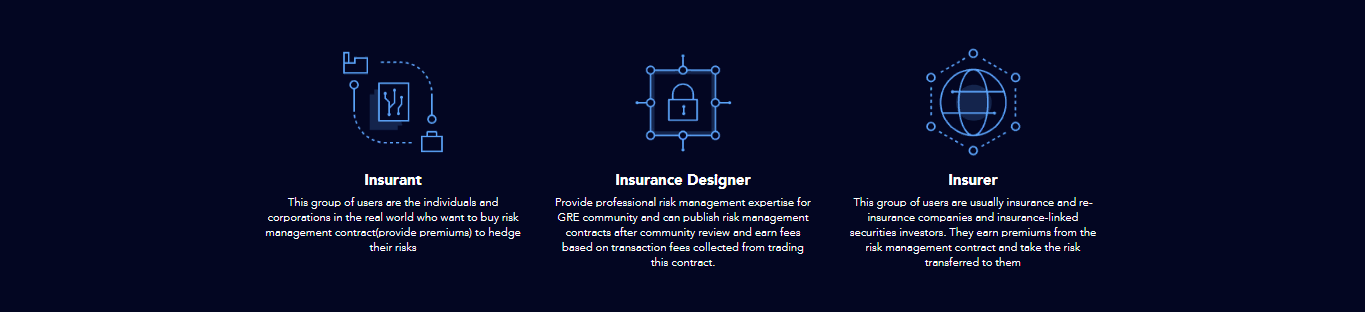

GRE uses a decentralized exchange based on the blockchain to help participants in the risk management contract, the policyholder (the party that pays for the premium and sells its risks), the insurer (the party that receives the premium and assumes the risks of the other party) and the contract designer which measures individual risks and construct a contract), execute transactions and profit from own information and understanding of risks. The market price of a risk contract is a market consensus and the wisdom of the crowd, which is the best risk measurement at the moment. GRE allows to significantly increase the base of insurance providers, in addition to traditional insurance companies and reinsurance companies, which are centralized, tightly regulated and capital intensive.

GRE is committed to building an infrastructure and trading platform for the risk management industry in a block-driven world in the near future, providing a fundamental protocol for creating risk events, pricing, trading, information gathering and verdict. This will allow individuals and institutions around the world to achieve a balance between risk and return.

How Blockchain Technology reviews insurance

Personalized

Everyone in the locker can publish personalized insurance needs and uses a sales contract to match the corresponding insurance capabilities, which leads to truly individual insurance protection for everyone.

Deconstruction of the insurance company, increase of efficiency Expand the traditional insurance company into three parts: the sales channel, actuariness for registration of insurance contracts and insurance opportunities. For sales channels, more sales are initiated by people who need insurance, rather than selling a group of products owned by people. Actuaries in insurance companies can freely publish their own products on a block chain and allow the market to determine which one is being sold and to profit from transaction fees, therefore, bypassing the tedious internal approval process. By encouraging any means that are able to provide insurance opportunities, any person, company or organization can use its ability to assess risks for profit and maximize opportunities for specific risks.

Confidentiality and protection of personal data.

Personal identification and information about the properties are safely stored in a block chain, and the possession of confidential information is entirely in the hands of the user.

The only way to view personal information is an intellectual identification agreement, and only those who have private keys can allow others to view their personal information deciphered. The economy of tokens stimulates the community to contribute All people or organizations that contribute to the community are rewarded with tokens based on predetermined community rules, which gives community members a sufficient incentive to participate and form a long-term relationship with the community.

Automatic execution of the application Smart Smart

Claims under the insurance contract are automatically performed under a reasonable contract in accordance with the oracle, which eliminates the human conflict in the process of filing claims. In addition, all bonuses and capacity are locked in a smart contract in token forms, and tokens are automatically distributed through intellectual contracts, which eliminates counterparties.

CONCEPT

All risk management transactions on the GRE platform use the RISK token as a transaction intermediary, and will use RISK to calculate the contracts.

Users of the GRE platform will pay transactional fees using the RISK token.

Any organization or individual can create a risk management contract on the GRE platform after a review of the community and receive a reward for the volume of transactions.

The community will reward developers with a RISK marker based on their contribution to the code.

All individuals and entities can share contracts on the GRE platform and attract new customers to risk management contracts in the field of trade, and they will receive a fee from the transaction fee charged to the new customers they invite.

Exchange dealers on the GRE platform can RISK as a security to issue markers linked to the market, such as GRE.USD or GRE.CNY. This mechanism is similar to BTS and BITUSD in the Bitshares ecosystem.

GRE will generate a total of 10 billion (10,000,000,000) RISK tokens based on the Ethereum ERC20 standard. The GRE Foundation will be considered as the initiator of all RISK tokens. Users can purchase RISK through airdrop and cryptocurrency exchanges after the release of RISK. RISK is a utility token that can only be used on the GRE platform for payment by users participating in risk management contracts and payment of claims or results in accordance with oracles. Different participants (insured, insurers and contractors) conduct different amounts of RISK in accordance with their requirements.

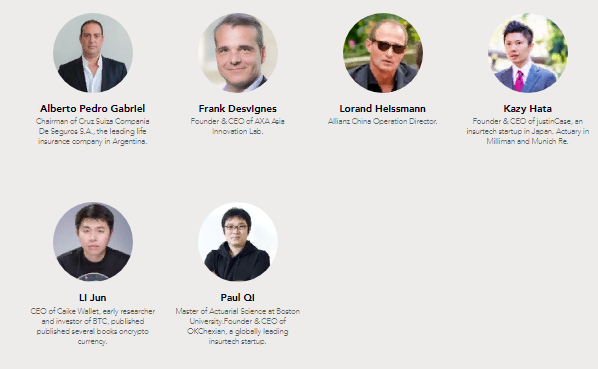

Team Global Risk Exchange

information:

Official website:https://www.gref.io

Twitter: https://twitter.com/GRE_RISK

Telegram: https://t.me/GREF_EN

Whitepaper: https://www.gref.io/gre.whitepaper.en.pdf

Tidak ada komentar:

Posting Komentar